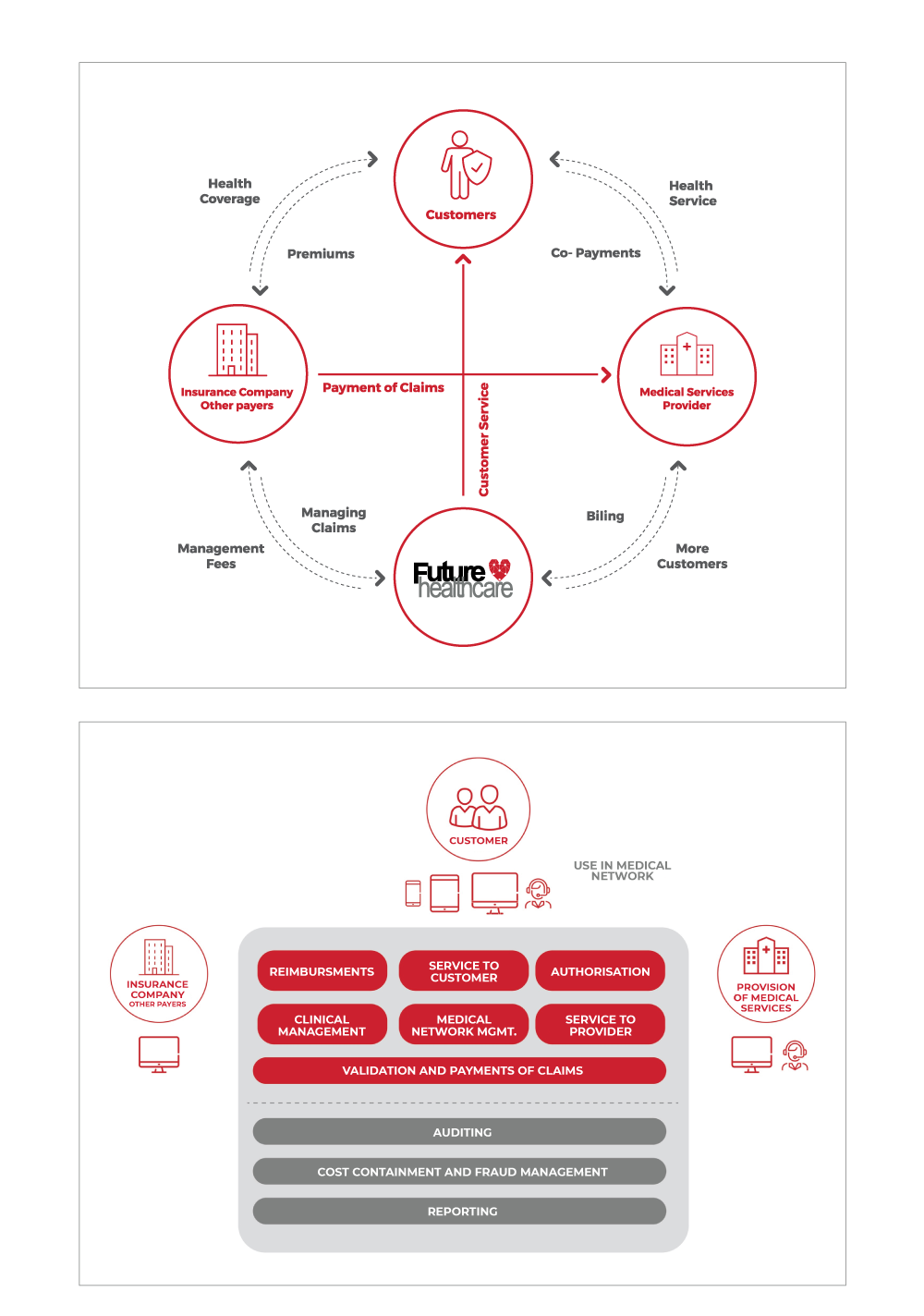

In the context of managing Health and Life Insurance portfolios, Future Healthcare developed all its procedures based on its technological platform, available on the Cloud and based on open standards. This allows a perfect interaction with the systems of our Institutional Customers. We seek to respond to all needs, from product design, through the subscription process, to full management of all operating and clinical processes necessary to manage a Health and Life Insurance.

Our methodology has a managed care approach, based on rigorous guidelines, developed according to the best international practices and over 15 years of experience in managing large portfolios, which allows us to address an increasingly competitive market and an ever-greater demand from our customers.

One of the main differences compared with a classic TPA is the fact that Future Healthcare personalises all its processes to the image and needs of each of its Corporate Clients, thus avoiding a “one size fits all” strategy. Therefore, working as an extension of our Customer, we become part of your Operating strategy, in order to achieve service excellence.

Services

Medical Underwriting

Medical Underwriting is a basic stage for any Health and Life Insurance company. The competitive environment constantly demands new products, with greater insured amounts, resulting in the need for a more rigorous risk selection and, consequently, more sophisticated procedures and evaluation tools.

Our platform allows immediate contact with the customer during the sales process, ensuring an immediate decision for most of the situations being evaluated. The Medical Underwriting platform includes the possibility of performing a clinical evaluation by Telephone Interview or by filling out an online form, via PC or mobile, according to the contact method suggested by the Customer. The platform was developed to be adaptable to the different distribution channels - online, face-to-face, telephone or over the counter.

The parametrisation of the questions to be achieved, as well as the decision algorithms, may be adaptable and configurable according to the risk management policy defined by the Corporate Customer. On the other hand, mechanisms may be developed for integration with the platforms for Reinsurance Underwriting, thus guaranteeing the automatic application in real time of all of the algorithms developed by the reinsurer partner of our Corporate Client.

ManagedCare Management

Our vision for efficient management is based on a management centred on the beneficiary, ensuring the follow-up on his health status and investing in the quality of life of the individuals we serve. We believe that a portfolio of healthy customers, with habits that prevent illness and promote health, will contribute to a better financial health for the payer (insurance company or self-financed company).

Our methodology has a managed care approach, and is based on rigorous international guidelines. One of the main differences compared with a classic TPA is the fact that Future Healthcare personalises all of its procedures to the image and needs of each of its Corporate Clients, thus avoiding a “one size fits all” strategy. Thus, working as an extension of our customers, we integrate their processes into our operating model, with the aim of achieving service excellence.

Future Healthcare has a sophisticated technological platform, available on the Cloud and based on open standards, that allows the involvement of all participants – Insurance Company, Medical Service Providers and the Customer – in a unique technological environment designed to respond to all of the needs inherent to managing Health Insurance. The analytical and management reports we provide are a clear advantage for our customers and allow better management of risk and financial performance.

Health Portfolio Management

Since the start of its activity, Future Healthcare has always positioned itself in order to provide its customers with access to the best conditions of health, life and well-being, placing each of the persons being managed at the centre of their clinical, operating and administrative processes.

Besides managing Health and Life Insurance, our platform also allows us to manage health solutions without risk, based on access to medical providers within the Future Healthcare Medical Network. This type of offer allows unlimited access to health care and may cover the entire population, namely the chronically ill or seniors who, in the case of a traditional health insurance offering, may have limited access and/or have a set of very significant restrictions.

All of the operating systems associated with managing this type of product are managed through our technological platform. We invest in the dematerialisation and automation of all processes under management, ensuring a service of excellence and proximity to all customers and medical providers.

Cost Containment & Claims Audit

To achieve financial sustainability in a health insurance operation, there should be a wide-ranging strategy for cost containment and fraud control. This involves permanent monitoring of the behaviours of customers and providers, as well as constant analysis of usage data.

Our technological platform allows customisation of the rules and actions to be implemented according to the Corporate Customer policies. The Cost Containment and Fraud Control modules may be integrated into the systems of our Customers, allowing control and follow-up in the context of their daily routines. Our methodology incorporates guidelines and international medical codification.

Apart from actions and rules that are initiated in real time, there is also a specific analysis carried out periodically, using various data analysis mechanisms, harnessing the forecasting and identification of possible cases of abuse or fraud.

© FH Corporate Ecuador 2026, | Legal Notice | Terms and Conditions | Privacy Policy

| WHISTLEBLOWING

English (UK)

English (UK)  Español

Español